Segment Information

1. Management Service

Our Professionals provide a wide range of management support services in 15 offices around the world, mainly in Asia. it provides mainly PMO-type execution support services such as M&A and DX implementation for clients. As a result, the overseas ratio of revenue has achieved approximately 50% in Management Service business

2. Principal Investments

Utilizing the professional platform cultivated through the Management Service business, we invest our own funds in small and medium-sized emerging companies. Currently, we are making long-term investments in the personal care and pet care fields as focus areas, and also actively invest in business seeds as strategic investment areas which will become a focus industry in the future.

Segment Information

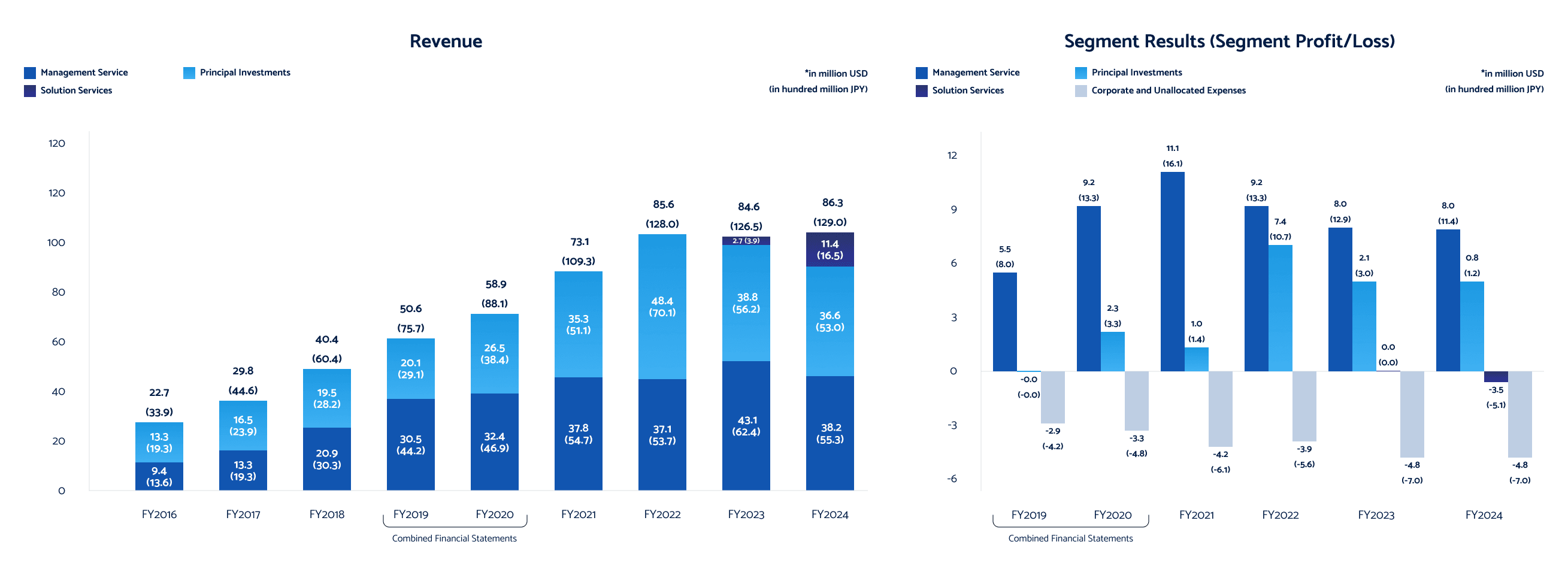

| FY2016 | FY2017 | FY2018 | FY2019 | FY2020 | FY2021 | FY2022 | FY2023 | FY2024 | |||

| Management Service | Revenue | in million USD | 9.4 | 13.3 | 20.9 | 30.5 | 32.4 | 37.8 | 37.1 | 43.1 | 38.2 |

| in hundred million JPY | 13.6 | 19.3 | 30.3 | 44.2 | 46.9 | 54.7 | 53.7 | 62.4 | 55.3 | ||

| Segment Profit/Loss | in million USD | - | - | - | 5.5 | 9.2 | 11.1 | 9.2 | 8.9 | 7.9 | |

| in hundred million JPY | - | - | - | 8.0 | 13.3 | 16.1 | 13.3 | 12.9 | 11.4 | ||

| Solution Service | Revenue | in million USD | - | - | - | - | - | - | - | 2.7 | 11.4 |

| in hundred million JPY | - | - | - | - | - | - | - | 3.9 | 16.5 | ||

| Segment Profit/Loss | in million USD | - | - | - | - | - | - | - | 0.0 | -3.5 | |

| in hundred million JPY | - | - | - | - | - | - | - | 0.0 | -5.1 | ||

| Principal Investments | Revenue | in million USD | 13.3 | 16.5 | 19.5 | 20.1 | 26.5 | 35.3 | 48.4 | 38.8 | 36.6 |

| in hundred million JPY | 19.3 | 23.9 | 28.2 | 29.1 | 38.4 | 51.1 | 70.1 | 56.2 | 53.0 | ||

| Segment Profit/Loss | in million USD | - | - | - | - | 2.3 | 1.0 | 7.4 | 2.1 | 0.8 | |

| in hundred million JPY | - | - | - | - | 3.3 | 1.4 | 10.7 | 3.0 | 1.2 | ||

| Corporate and Unallocated Expenses | in million USD | - | - | - | -2.9 | -3.3 | -4.2 | -3.9 | -4.8 | -4.8 | |

| in hundred million JPY | - | - | - | -4.2 | -4.8 | -6.1 | -5.6 | -7.0 | -7.0 | ||

Segment income (loss) has not been prepared for FY2016 to FY2018, as we did not manage segment income (loss) in the same way as for FY2019 and forward. The segment profit/loss of the Principal Investment business prior to FY2022 includes the gain on valuation of financial assets at fair value through profit or loss related to the shareholding in Ipet Insurance Company Limited (Ipet Holdings Company Limited from October 1, 2020) (FY2019: USD 1.1 million; FY2020: USD 0.8 million; FY2021: USD -0.1 million; FY2022: USD 4.9million) The results of SOLIA, Inc. are excluded from the results of the Principal Investments from FY2023 onwards. The results of Solutions Services for FY2023 differs from the disclosed Tanshin(短信), using the results of Supply Chain division (audited); Digital Transformation devision (unaudited); and Interactive Solution devision (unaudited)

Telegraphic Transfer Middle Rate (TTM) of Mizuho Bank dated June 30, 2025 (latest quarter period ending) of 1 USD = 144.82 JPY is used for conversion on this website.

Sign up for our Investor Relations Newsletter

Get the latest YCP Holdings recent investor-related reports and corporate updates delivered right to your inbox.

We care about the protection of your data. Read our Privacy Policy.